real estate tax shelter example

Regular mail through the post office. The tax shelter ratio is the aggregate amount of deductions to the amount invested.

How To Pay No Taxes With Real Estate Investing Youtube

Key Takeaways A tax shelter is a place to legally store assets so that current or future tax.

. Set up an Owner-occupied Real Estate Tax Payment Agreement OOPA Submit. A tax shelter is a place to legally store assets so that current or future tax liabilities are minimized. The IRS defines a qualified retirement account QRA as an account that meets certain requirements such as.

Code of Federal Regulations. It is true if you plan to use deductions as a tax shelter. In this article well take a look at how investors can calculate a baseline tax.

In this article well take a look at how investors can calculate a baseline tax shelter on their real property assets. Shelter Bay Condos was constructed in 1983 these condos are exceptionally large spacious luxury homes. Streamlined Document Workflows for Any Industry.

But there is a catch whenever you. How do real estates use tax shelters. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b.

When it comes to rentals it is easy to lose money especially if the rental income does not cover the mortgage you have several repair bills among other things. Estate Trust Tax Services. Examples of Tax Shelters.

Learn How EY Can Help. In other words you are having to put money into the investment to keep it. Tax Collector Township of Piscataway 455.

Tax-sheltered assets include qualified retirement accounts certain insurance products partnerships municipal bonds and real estate investment trusts. Insurance premiums are not deductible for homeowners. These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b.

In 2022 employees can make up to 20500 in deductible contributions to a 401 k with workers age 50 and older entitled to deduct an additional 6500 in catch-up contributions. The Tax Court has consistently disallowed losses deductions and credits from transactions it deems to be tax shelters. The tax shelter ratio is the aggregate amount of deductions to the amount invested.

Ad State-specific Legal Forms Form Packages for Investing Services. In 2011 Michael Dell reportedly qualified his 714 million 1757-acre Texas ranch for the tax credit and brought its assessed. Sometimes in order to save money you must spend money.

A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1. A traditional individual retirement account IRA is another example of a tax shelter and works in nearly the same way as a 401k account. Yes it is because it shelters your income.

Paradigm shift in new Sec. Fire Inspections Safety Permits. Leave in the dropbox at the Township Administration Building 455 Hoes Lane Piscataway NJ 08854.

For example whenever Im giving services to my clients using my energy to provide for a service that is an active income. 4525 14 Shelter Bay Condos Edgewater New Jersey Located directly on the Hudson River Shelter Bay Condos offers 60 townhouse residences containing large 2 2 3-Br duplex and triplex units. Fire Prevention Home Safety.

These are cash losses. Real estate offers tax sheltering through depreciation operating expenses long-term capital gains and 1031 exchanges. Although there are a few legal ways to minimize your taxes sheltering is one of the easiest methods to use by making for example pre-tax contributions to tax shelters reducing your taxable income and thereby reducing your tax liabilities.

A step-up in basis is another instrument that provides tax shelter although not directly to the initial investor. Smoke Carbon Monoxide Detectors. Three Common Tax Shelters in Real Estate.

To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section 1031 exchange. 455 Hoes Lane Piscataway NJ 08854 Phone. If you earn 20000 annually for example and utilize tax shelters worth 5000 your taxable income reduces to 15000.

To shelter real estate investment cash flow from taxes emphasize to investors that they can buy like-kind properties through tax-free exchanges also referred to as a Section 1031 exchangeIn this case an investor can buy a second property without paying tax on the sale of the first property. Set up an Owner-occupied Real Estate Tax Payment Agreement OOPA Submit an Offer in Compromise to resolve your delinquent business taxes. Ad Committed to Delivering High-Quality Tax Services for Sophisticated Financial Needs.

In Re Estate of Jack 484 NYS2d 489 NY. The benefit of this plan is that you are required to pay tax on 450day 500-50 and not on the entire sum of 500. While our team has dedicated thousands of hours to research we arent able to cover every product in the marketplace.

Using Deductions as a Tax Shelter. Then when it comes time to sell you can reduce or avoid capital gains taxes. Find Forms for Your Industry in Minutes.

A tax shelter is among other things any investment that has a tax shelter ratio exceeding 2 to 1. Rental real estate natural resource prospecting film production and alternate energy sources are examples of common tax shelters. However New York courts and the Department of Taxation and Finance have long held the position that interests in cooperative apartments are not real property and instead treat such interests as intangible personal property for purposes of New York estate tax.

Why go small when you can go bi. Property Tax Reimbursement Form PTR submissions. Is Real Estate a tax shelter.

Common examples of tax shelter are employer-sponsored 401k retirement plans and municipal bonds. For example using the case where the IRS interactive tax assistant calculated a standard tax deduction of. In that case that income 100 taxable and I can only match that active income with active expenses.

To be a tax shelter the investment has to lose money. Suppose you earn 500day and decide to set aside 10 of your income in the 410k plan. Now 50 will be kept aside per day as an investment in any of the tax shelters.

Propane Fueled Cooking Equipment. But first some backdrop-. But according to The Nation the rich are using it as a tax shelter.

These examples of tax shelters apply to real estate but there are others including tax-deferred retirement accounts 401ks and tax-sheltered annuities 403b.

How To Pay Less Tax When You Sell Your Cottage Mawer

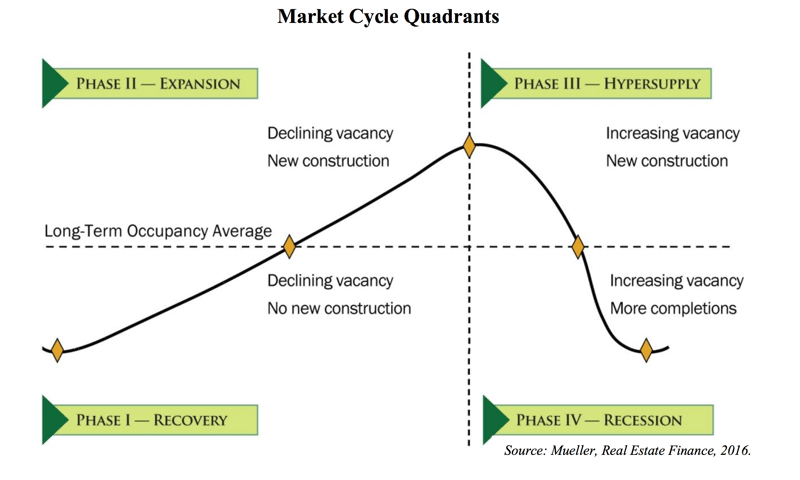

Canadian Real Estate Works In A Cycle Here S Where We Are Better Dwelling

The Four Phases Of The Real Estate Cycle Crowdstreet

Real Assets Examples Of Investments And Classification Types

How To Pay No Taxes With Real Estate Investing Youtube

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

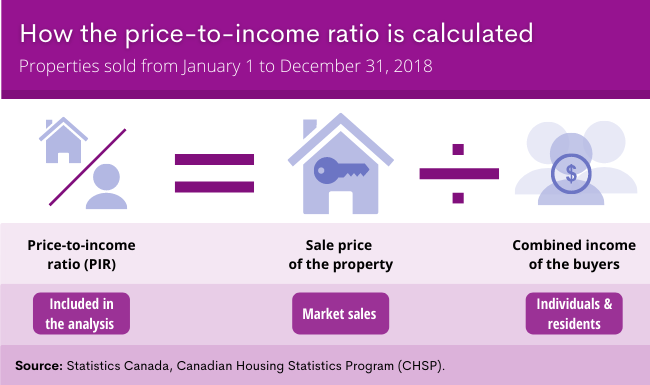

Residential Real Estate Sales In 2018 The Relationship Between House Prices And Incomes

The Benefits Of Owning International Real Estate

How To Avoid Capital Gains Tax On Real Estate Canada Ictsd Org

How Is A Tax Shelter Calculated In Real Estate

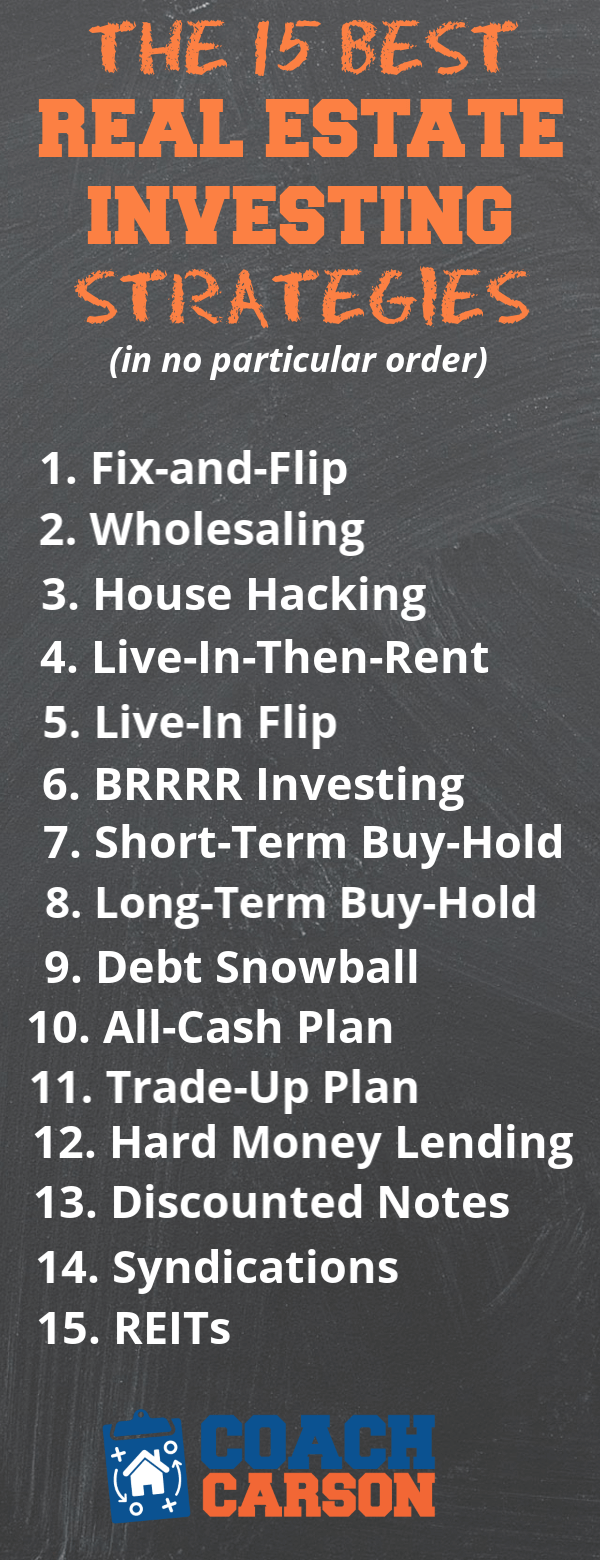

The 15 Best Real Estate Investing Strategies Coach Carson

15 Best Real Estate Stocks In Canada 2022 Be A Lazy Landlord

Tax Deductions On Rental Property Income In Canada Young Thrifty

How To Decide If A Property Is A Good Investment The Washington Post

How You Can Make Money From Your Rental Show A Loss On Your Tax Return Semi Retired Md

Royal Lepage Triland Realty Sample E Card Royal Lepage Royal Realty

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

:max_bytes(150000):strip_icc()/mortgage-real-estate-investing-guide-4222543-v1-b49c49405ee14779adb25d2879411414.png)